Regel 1 - Der Klassiker: Sonne lacht, Blende 8!

Das kennt jeder, der schon mal eine Kamera in der Hand hatte. Dummerweise beißt sich das mit diversen anderen Weisheiten, angefangen von: „Für Mensch und Tier nimm Blende vier.“, "Blende auf drei – der Hintergrund ist Brei." bis hin zu "Ist selbst Blende 2 zu knapp, nimm einfach den Deckel ab."

Anwendbar: Jein! Diese Regel beschreibt einen Sachverhalt, der so dermaßen allgemein ist, dass man kaum sagen kann, ob es Sinn macht sie zu befolgen. Grundsätzlich ist an sonnigen Tagen nichts zu sagen gegen Blende 8. Man schränkt sich aber kreativ sehr ein, wenn man sich stoisch daran hält. Während Landschaftsfotos meist noch gut gelingen sollten, stößt man bei Bildern mit Portraitcharakter unter Umständen schnell ans gestalterische Limit. Beispielsweise hält sich der Freistellungseffekt mit Blende 8 stark in Grenzen (bis hin zu ist nicht existent), wenn nicht gerade ein riesiger Abstand zwischen Model und Hintergrund besteht.

Regel 2 - Sunny Sixteen: Belichtungszeit = 1 / ISO bei Blende f/16

Oder in Worten: an einem sonnigen Tag, stell die Blende auf f/16 und belichte so lange wie der Kehrwert der eingestellten ISO Empfindlichkeit (also z.B. 1/400 s bei ISO400). Erscheint diese Regel auf den ersten Blick ähnlich allgemein wie die erste, so existieren hier immerhin noch diverse Verfeinerungen (f/22 bei Schnee/Sand, f/11 für leichte Bewölkung, f/8 für normale Bewölkung, f/5.6 für starke Bewölkung, f/4 für Sonnenauf-/untergänge).

Anwendbarkeit: Nein. Diese Regel stammt aus einer Zeit, in der der ISO Wert durch den eingelegten Film fest vorgegeben war .Heute kann man wesentlich flexibler auf die herrschenden Lichtverhältnisse reagieren. Außerdem liegt f/16 bei vielen Objektiven bereits hinter dem sog. "sweet spot" (die Blende, mit der das Objektiv die schärfsten Resultate erzielt). Das heißt, die stark geschlossene Blende verursacht bereits wieder Beugungsunschärfen und somit generell unschärfere Bilder als eigentlich möglich. Nicht zuletzt schränkt man sich hier ähnlich stark kreativ ein wie bei Regel 1.

Regel 3 - Looney Eleven: Belichtungszeit = 1 / ISO bei Blende f/11

Diese Regel ist das Äquivalent zu Regel 2, nur das Szenario ist ein anderes, nämlich die Mondfotografie. Auch diese Regel ist sehr allgemein, was aber nicht ganz so schlimm ist, denn die Situation ist auch deutlich eingeschränkter. Wenn man den Mond fotografiert, hat man fast immer viel schwarz und einen helleren Punkt im Bild (es sei denn man trickst mit den Double Exposure Features von modernen Kameras). Wenn man nicht gerade ein Teleskop zur Verfügung hat, ist dieser helle Punkt auch nie übermäßig groß.

Anwendbarkeit: Ja! Diese Regel wird zwar nicht unbedingt beim ersten Versuch ein korrekt belichtetes Bild hervorbringen, bietet aber einen ausgezeichneten Startpunkt für Belichtungsanpassungen. Man liegt selten komplett daneben. Praxis-Pro-Tipp am Rande: Displayhelligkeit so gering wie möglich einstellen, während man den Mond fotografiert. Die Augen haben sich irgendwann an die Dunkelheit gewöhnt und es besteht die Gefahr, dass man mit einem zu hell eingestellten Display alles als Überbelichtung interpretiert. Aber am besten sowieso immer in RAW fotografieren, da kann man dann hinterher noch fast alles regeln.

Regel 4 - Belichtungszeit bei "Mitziehern": 1 / Geschwindigkeit des Subjekts in km/h

Sogenannte Mitzieher sind Fotos, bei denen die Kamera während der Belichtung einem sich bewegenden Subjekt folgt. Mit etwas Übung bleibt so das Subjekt scharf, aber der Hintergrund verwischt. Auf diese Art und Weise entstandene Bilder vermitteln gut den Eindruck von Bewegung, Dynamik und Geschwindigkeit. Es stellt sich in diesem Fall aber die Frage: wie lange muss man für einen Möglichst guten Effekt belichten? Eine zu kurze Belichtung reicht nicht aus um das gewünschte Gefühl zu vermitteln. Eine zu lange Belichtung kann die Umgebung des Subjektes komplett unkenntlich machen und führt sehr wahrscheinlich auch beim Subjekt selbst zu einer verwackelten Darstellung. Eine Antwort gibt diese Mitzieher-Regel. Beispielhaft: Fotografiere den Rennradfahrer, der mit 40km/h fährt 1/40 Sekunde lang und den Sportwagen auf der Rennstrecke, der mit 250 Sachen an dir vorbeirauscht, mit 1/250 Sekunde.

Anwendbarkeit: Jein! Natürlich kommt es auch auf die Brennweite und den Abstand zum Motiv an, aber sobald das Subjekt das Bild einigermaßen gut ausfüllt, kann man sagen: diese Regel produziert brauchbare Ergebnisse. Beispielhaft zeigt das folgende Bild ein Foto, das ich mal auf einer Hochzeit geschossen habe. Die Belichtungszeit war 1/40 Sekunde und wir waren vielleicht etwas schneller unterwegs, maximal aber 50 km/h.

Regel 5 - Maximale Belichtungszeit bei Astrofotografie (die "600er Regel"): 600 / (Brennweite * Cropfaktor)

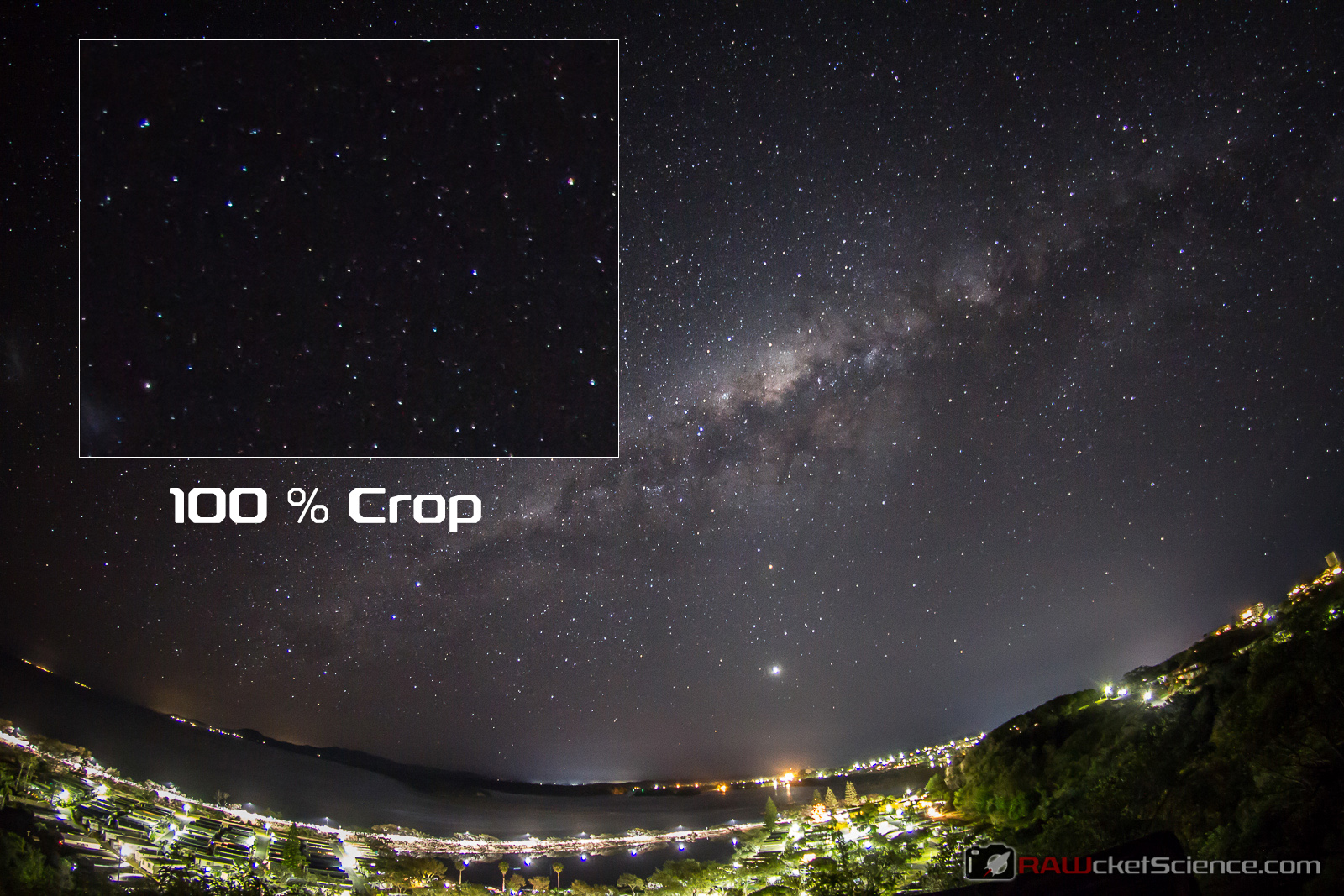

Diese Regel läuft einem auch häufiger als 500er Regel über den Weg, was aber deren Inhalt nicht extreeem verfälscht. Möchte man den Sternenhimmel fotografieren, "verwischen" die einzelnen Sterne aufgrund der Erdrotation während einer Langzeitbelichtung. Die verwendete Brennweite hat einen maßgeblichen Einfluss darauf, wie schnell das passiert (übrigens auch die Auflösung des Kamera Sensors, aber wir wollen es an dieser Stelle nicht unnötig kompliziert machen). Möchte man diesen Verwischungseffekt nicht haben, sollte man nicht länger belichten, als diese Regel vorgibt. Beispiel 24mm Objektiv an einer APS-C Kamera: 600 / (24*1,6) = 15,6 Sekunden. Belichtet man länger, ziehen die Sterne Spuren im Bild (was manchmal natürlich aber auch erwünscht sein kann).

Anwendbarkeit: Ja! Das kommt in etwa hin. Wenn man nicht gerade mit einer 150 MP Kamera Bilder macht, die hinterher auf Hauswände tapeziert werden sollen, funktioniert diese Regel ziemlich gut. Das folgende Bild zeigt ein zugegebenermaßen etwas extremeres Beispiel. Verwendet wurde ein 8mm Fisheye an der Canon EOS 7D. Das heißt: 600 / (8 * 1,6) = max. 46,8 Sekunden. Das Bild wurde aber "nur" 30 Sekunden belichtet. Es hätte also noch etwas zeitlichen Puffer gegeben. Dafür gibt's aber auch absolut keine Anzeichen von Verwischungen.

Fazit:

Nicht alle Weisheiten aus analogen Tagen machen heute noch Sinn, aber erstaunlich viele. Gerade die Mitzieher- und die 600er Regel haben durch den technischen Fortschritt nichts an Gültigkeit eingebüßt und es kann sich lohnen, sie im Hinterkopf zu behalten.

P.S.: Widersprüche oder Ergänzungen gerne in die Kommentare!